Single Touch Payroll -Changes to Payment Summaries

Single Touch Payroll (STP) has resulted in changes to end of financial year processes for employers and employees.

Information for Employers

If you are an Employer, and you have started reporting STP, end of financial year will be simpler moving forward.

If you are already filing STP reports, you will not be required to provide PAYG summaries to your employees or lodge a Payment Summary Annual Report – as the information is already being reported through the STP reports you are filing.

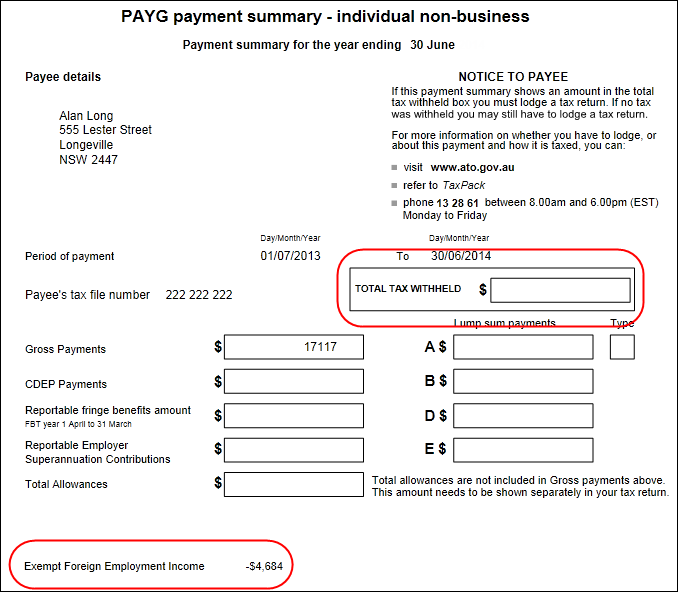

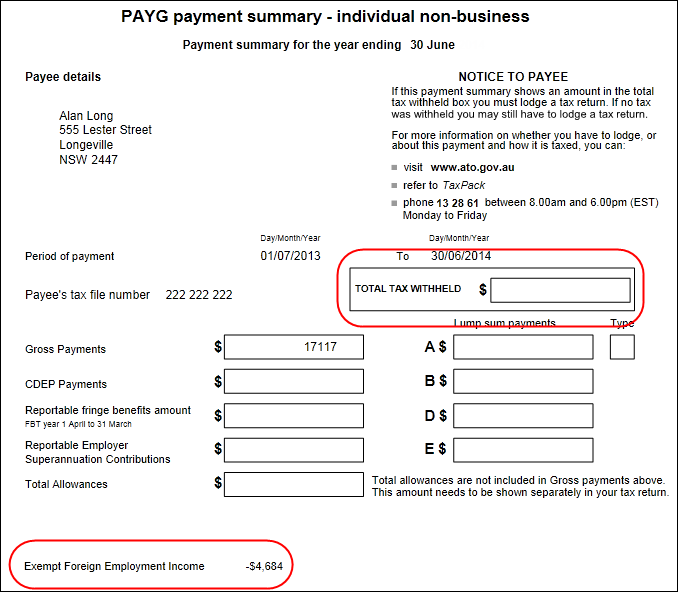

These PAYG summaries you will not need to produce moving forward include:

- PAYG payment summary – individual non-business (INB)

- PAYG payment summary – foreign employment income (FEI)

- PAYG payment summary – Employment Termination Payments (ETP).

You will not have to provide payment summaries for the following payments if you reported them voluntarily through STP:

- Payments under voluntary agreement

- Payments under a labor hire arrangement

- Death benefit employment termination payment.

It is very important to note; you will need to continue to provide PAYG summaries for any payments you have not reported through STP this financial year.

If you are an Employer, in order to close out the 2018-19 financial year, you will need to submit a Finalisation Declaration via your STP software. If you are a Xero user, you can review the work instructions here.

It is important to finalise all employee records reported through STP as soon as they are ready. The sooner information is finalised, the sooner it will display as ‘Tax ready’, allowing your employees to process annual tax return.

In mid-May, all employers registered to file STP reports will receive an email from the ATO to let you know about your end of year reporting obligations.

Information for Employees

Moving forward, you will no longer receive a PAYG Summary. PAYG summaries will be replaced by income statements, which can be access through the Australian Tax Office app via myGov. If you do not have a myGov account, create an account online at myGov.

Your Accountant will also have access to your income statements through the ATO Tax Agent Portal.

With this change of process, it is important that you let your employees know:

- They will not be receiving a PAYG Summary as the ATO have been informed of their payments through the STP filing process.

- Income Statements will replace PAYG summaries.

- Employees can access their Income Statements through ATO online via myGov at any time.

- Employees need to wait until the Income Statement has a status of ‘Tax ready’ before they can lodge their Tax Return.

Finalisation Process for Employers – Finalising your Single Touch Payroll Data

In order to be exempt from issuing PAYG summaries to your employees, you will need to make a Finalisation Declaration using your STP software. This process declares that you have provided all the required information for the financial year through your STP reporting.

As an employer, you can make a finalisation declaration by providing a finalisation indicator for each employee (including Directors, Contractors, etc.) as part of your STP reporting. If you are a Xero user, you can review the work instructions here.

Once you have provided the finalisation indicator for each employee, the ATO will pre-fill the employee’s income tax return and display the information as ‘tax ready’ in the employees myGov records.

It is important to know, you can make a finalisation declaration for an employee any time during the financial year (for example, when an employee ceases employment with you), or after the end of the financial year – up to 14 July.

The ATO has provided additional time for employers to make a finalisation declaration in their first year of reporting through STP:

- Employers who started reporting in the 2017–18 financial year have until 14th August 2018.

- Employers who start reporting in the 2018–19 financial year have until 31st July 2019.

If you need more time, you can apply for an extension.

receiving a PAYG Summary as the ATO have been informed of their payments through the STP filing process.

Penalties for Non-Finalisation

If you are reporting payroll via STP, you may incur penalties if you don’t make a finalisation declaration by 14th July each year.

Finalization Declarations Made During the Financial Year

If you make a finalisation declaration during a financial year, you do not need to provide the employee with a part-year PAYG Summary.

If you find yourself in a situation where you’ve already made a finalisation declaration for an employee but due to new (additional) payments, you need to amend the declaration, consider the following options:

- if it is a one-off additional payment – make another finalisation declaration when you report the new payment.

- if you expect to make another payment (for example, if you re-hire the employee), unselect the finalisation indicator and wait until the end of the financial year to make another finalisation declaration.

It is important to note that regardless of when you finalize an employee, the income statement will not be available until after the end of the financial year.

Amendments After Finalization

If you need to amend the payment details after making a finalisation declaration you should submit an ‘update event’ as soon as possible. The ATO requests that an ‘update event’ be lodged within 14 days of identifying the need for an amendment.

If this is the case, you should submit an ‘update event’ with the finalisation indicator removed and the previous payment details. The ATO will then be aware that the current information is not final and should not be used to produce the income statement.

You can amend finalised information reported through STP up to five years after the end of financial year.

Over-payment in the Previous Financial Year

If you discover that you have overpaid an employee in a previous financial year, it is important to submit an ‘update event’ to advise the ATO of the correct payment the employee should have received in the relevant financial year. In this case it is important not to adjust the amount of tax withheld. You should provide an ‘update event’ for every financial year in which an over-payment occurred.

If you have any questions or need advice and clarity specific to your business, feel free to contact Semmens & Co on 03 8320 0320 for a free consultation.